In one of the biggest mergers of the year, Take-Two purchased Zynga in a deal that closed at a whopping $12.7 Billion. Taking the world by storm, this merger comes with its pros and cons. Here we explore what this acquisition means for the Zynga shareholders.

Who is Take Two?

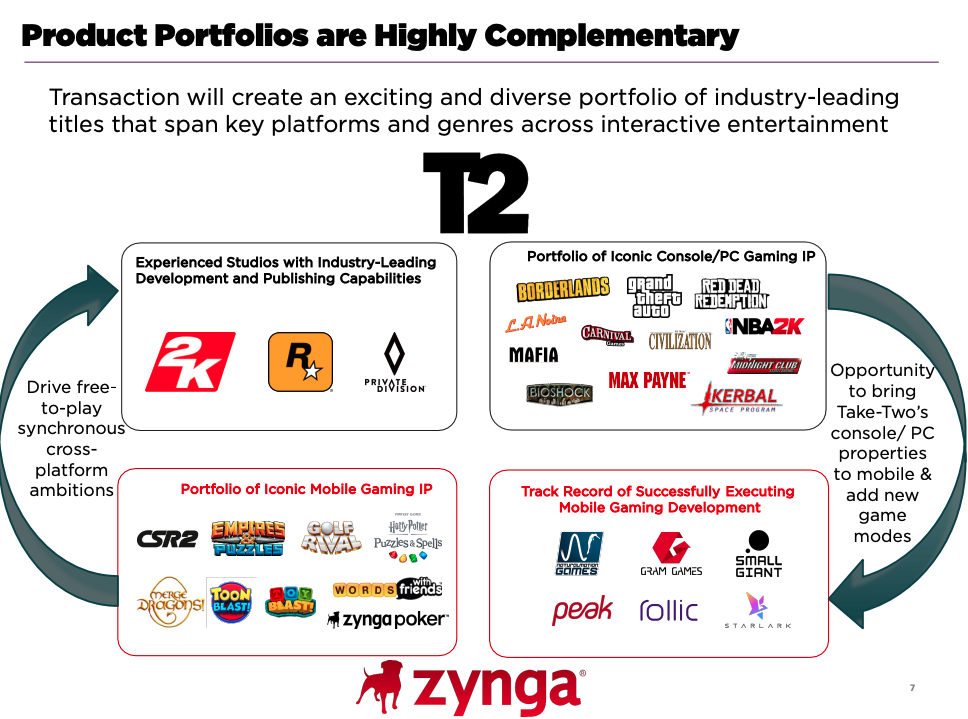

With the position of one of the biggest and leading companies in the video game industry. Take-Two Interactive is home to some of the biggest names in gaming. From Grand Theft Auto to Borderlands, this 2k games company remains one of the leading developers of console gaming.

Who is Zynga?

Another giant in the world of gaming, Zynga focuses on entertaining those who prefer mobile gaming. With the rapid increase of mobile gaming audiences, it’s safe to say Zynga has accumulated quite a following. Therefore, the company remains famous for producing one of the biggest mobile games, Farmville. Additionally, Zynga is one of the best in the world of mobile gaming.

The video game merger of the century

The buying of Farmville creators, Zynga by Take-Two interactive has been classified as the biggest acquisition to ever take place in the video game industry.

This acquisition brings together two of the biggest giants in gaming, with Take-Two aiming to utilize Zyngas mobile gaming strategies in their console gaming.

The Chairman and CEO of Take-Two Strauss Zelnick mentioned in a statement that, “This strategic combination brings together our best-in-class console and PC franchises, with a market-leading, diversified mobile publishing platform that has a rich history of innovation and creativity,”

What this means for Zynga shareholders

For shareholders of Zynga, the merge might seem daunting at first. however, Take-Two has stated that all shareholders of Zynga $3.50 in cash and $6.36 in shares of Take-Two common stock for each share of Zynga outstanding stock at closing. The transaction is valued at $9.86 per share of Zynga common stock.

Additionally, the board of Take-Two will expand to encompass ten members, with an additional two from Zynga.